Implement App Maintenance Mode with...

November 25, 2025

In the rapidly evolving world of financial services, AI in Fintech is becoming a game-changer. Companies offering Banking and Financial Application Development Services are increasingly leveraging AI to drive innovation, enhance customer experiences, and improve operational efficiency. But what exactly is AI in Fintech, and why is it gaining so much attention?

The integration of AI in Fintech is reshaping the industry landscape. According to recent market insights, AI technologies are expected to drive significant growth in the fintech sector. From automating routine tasks to making data-driven decisions, AI is transforming how financial institutions operate, making processes more efficient and customer-centric.

AI, or Artificial Intelligence, refers to the simulation of human intelligence in machines, enabling them to perform tasks that typically require human intelligence, such as learning, reasoning, and problem-solving. Fintech, on the other hand, is a portmanteau of “financial technology” and encompasses the application of technology to improve financial services.

When combined, AI in Fintech enables financial institutions to offer more personalized, efficient, and secure services. The synergy between AI and Fintech is revolutionizing the financial sector, providing new opportunities for innovation and growth.

Also Read: Choose the Right AI Model for Your Business: Decoding AI

The adoption of AI in Fintech offers numerous benefits, including:

Improved Customer Experience: AI-driven chatbots and virtual assistants provide customers with 24/7 support, answering queries and resolving issues in real-time. This leads to enhanced customer satisfaction and loyalty.

Better Analytics: AI enables financial institutions to analyze vast amounts of data quickly and accurately. This leads to more informed decision-making, allowing companies to predict trends, identify opportunities, and mitigate risks.

Cost-Saving: By automating routine tasks and reducing the need for manual intervention, AI helps financial institutions save costs. This is particularly beneficial for processes like fraud detection, customer onboarding, and compliance management.

Also Read: AI in Banking: Customer Experience, Benefits, and Challenges

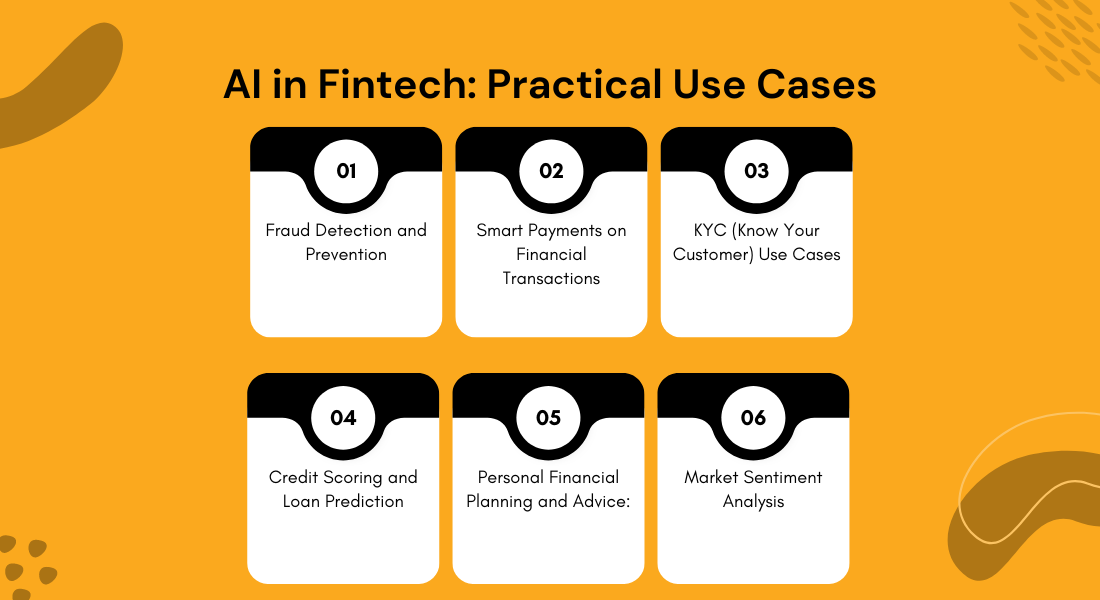

The practical applications of AI in Fintech are vast and varied. Here are some of the key use cases:

Fraud Detection and Prevention: AI’s predictive analytics capabilities are instrumental in identifying fraudulent activities. AI-powered chatbots can also act as the first line of defense, providing an additional layer of security.

Smart Payments on Financial Transactions: AI enhances the efficiency of financial transactions by personalizing the user experience and increasing transaction speed. It also strengthens security measures, reducing the risk of fraud.

KYC (Know Your Customer) Use Cases: AI streamlines the KYC process by automating identity verification, improving accuracy, and reducing costs. It also ensures compliance with regulatory requirements, minimizing the risk of penalties.

Credit Scoring and Loan Prediction: AI plays a crucial role in credit assessment by analyzing a borrower’s financial history and predicting their ability to repay loans. This benefits both lenders and borrowers, ensuring fair and accurate lending decisions.

Personal Financial Planning and Advice: AI-driven predictive analytics are transforming personal financial planning, offering users tailored advice based on their spending habits, income, and financial goals.

Market Sentiment Analysis: AI is also being used to analyze market sentiment, helping investors make informed decisions. By understanding market trends and consumer behavior, financial institutions can better manage risks and capitalize on opportunities.

One notable real-world example of AI in fintech is the use of AI-driven personal finance management apps like Cleo and Digit. These apps leverage AI to provide personalized financial advice, help users save money, and manage their budgets more effectively.

For instance, Cleo, an AI-powered chatbot, engages with users in a conversational manner, helping them understand their spending habits and offering tailored advice to improve financial health. It can analyze transaction history, predict future expenses, and even set aside small amounts of money for savings goals without the user having to manually do so.

Another example is Digit, an app that uses AI algorithms to analyze users’ spending patterns and automatically transfer small amounts of money from their checking accounts to savings accounts. The AI considers factors like upcoming bills, daily spending, and historical cash flow to ensure that users can save money without impacting their regular expenses.

These applications demonstrate how AI in fintech is not only enhancing user experience but also making financial management more accessible and efficient for everyday consumers.

Conclusion

The integration of AI in Fintech is not just a trend—it’s the future of the financial industry. By enhancing customer experiences, improving analytics, reducing costs, and ensuring compliance, AI is enabling financial institutions to stay competitive in a rapidly changing landscape.

As AI technology continues to evolve, we can expect even more innovative applications in the Fintech sector, driving growth and transforming the way we interact with financial services.

Inexture Solution can help you navigate this transformation and implement cutting-edge AI solutions tailored to your specific needs.